The Covid-19 pandemic is a global catastrophe that has affected billions of individuals worldwide, including Malaysia. In addition, the pandemic had significant consequences for the global economy, industries, small and medium-sized enterprises (SMEs), and large and listed enterprises (LLs). Therefore, experts anticipate that the slowdown of economic activity will begin in March 2020 and continue until an unspecified date in 2021 or later.

In the beginning, COVID-19 was a health crisis that soon morphed into a global economic crisis at incredible speed and size, unlike anything we have ever seen before. The ripple effects of this pandemic are still being felt worldwide, and it is unclear that the full implications of its influence will be known until the situation stabilizes. In this post, we will look at how COVID-19 has affected SMEs and LLs in Malaysia. Based on the study, SMEs and LLs business effects from COVID-19 can be discussed in 5 areas: financial, customer, technology, supply chain, and employee.

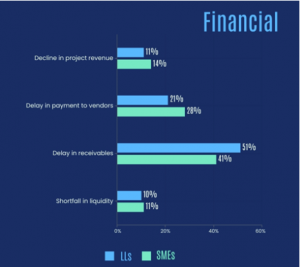

FINANCIAL

According to Bank Negara Malaysia (BNM) figures, financial concerns faced by SMEs were already apparent during the third quarter of 2019, owing to an average debt-to-equity ratio of 25% and a profit margin of only 5.7%. As a result, the effects of sudden shock situations on the stability of a corporation cannot be avoided. According to the results of an online survey on the sustainability of Malaysian SMEs conducted among 15,627 respondents, the majority of SMEs are extremely cash-strapped and expect to have no cash inflow for at least three months upon MCO due to multiple commitments such as staff salaries, rental payments, and other statutory payments. Approximately 33.3% of SMEs will only sustain their cash flow until March 2020, while 37.8% will sustain their cash flow until April 2020.

While for the large businesses, in contrast to the early months of the pandemic, there are indications of a slow but steady recovery; yet, liquidity seems to be a significant challenge, with the medium businesses having only two months of cash flow remaining. In October 2020, 60% of companies were already in difficulties or were on the verge of going into problems within the next six months. The tourism and transportation industries currently have the most considerable proportion of enterprises in difficulties, but the automotive and construction industries have the strongest impression of falling into financial hardship. Because of this widespread image of getting into arrears among businesses, many businesses are hesitant to take out loans for the risk of not being able to repay them.

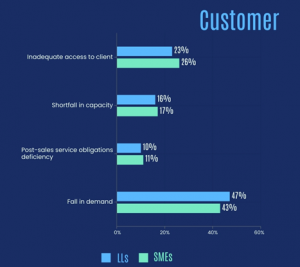

CUSTOMER

Across large and SME companies, nearly half of the respondents have cited that a fall in demand is their key challenge, followed by a lack of client access for their products.

To overcome the lack of demand, digitalization is the most effective way for both LLs and SMEs. The justification for digitalization is apparent for big businesses: it increases productivity, competitiveness, and scale of operations. Complex technologies, such as automation of production processes and data-driven quality control systems, can help businesses cut costs and boost profits.

The low levels of back-end digitalization among SMEs before the COVID resulted in reduced productivity, lower efficiency, and a lackluster performance in business operations during the MCO. The week after the compulsory MCO, 70% of SMEs reported a 50% decrease in their commercial activity. Comparing these numbers to those found in the digital space within the same time frame reveals that online non-food purchasing climbed by 53%, online grocery shopping increased by 144%, and online food delivery increased by 61%.

TECHNOLOGY

A total of 84% of SMEs reported experiencing challenges with their internet infrastructure and communications with clients and suppliers during the MCO survey. Meanwhile, for LLs, nearly a third of large and listed companies cited the inability to contact clients and suppliers as the major challenge.

SUPPLY CHAIN

Outages in the supply chain had a negative impact on sales and operations in the vast majority of companies. The failure of supply chain interruptions resulted in difficulty in completing sales orders for almost two-thirds of the impacted companies in October 2020. When it comes to supply chain shortages, exporters are hammered harder than non-exporters.

To deal with these interruptions, companies are employing a variety of tactics. These strategies include expanding supplier networks and boosting in-house manufacturing. Other than that, inciting large corporations to engage with SMEs, for example, by increasing their help in supply chains concerning financial recovery, raw material sourcing, and project outsourcing, can provide financial stability for SMEs and LLs for the time being.

EMPLOYEE

Most industries have seen a net loss in employment since the implementation of the MCO, which has had a considerable influence on employment levels. The most often implemented changes by businesses in October 2020 were the reduction of working hours and wages. Numerous employees were compelled or forced to remain home because the pandemic and self-isolation may be optional in several countries. In more seriously affected areas, the government may mandate non-essential employees not to break isolation restrictions. These restrictions may affect SMEs and LLs business in many ways, from delays in upskilling, completing projects, and operational downtime.